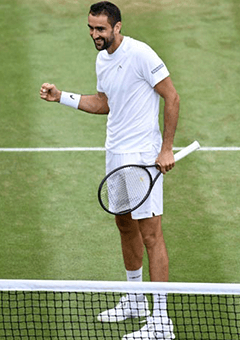

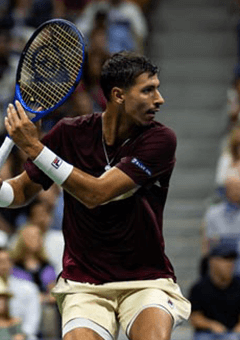

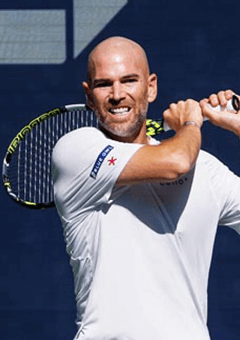

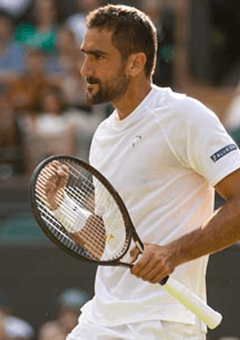

Serving

investors first

We take private markets as seriously as a match point. At Blue Owl, we've been investing in the private markets since day one. That laser focus helps us redefine alternatives. And inspires us to support the players who are redefining the game. So keep an eye out for Blue Owl at the Grand Slams—because we invest in excellence, both on and off the court.

Why Blue Owl?

Focus

Through our focused expertise and specialized product set, we aim to serve unmatched private market opportunities to our investors.

Scale

The size and scale of our investment platforms gives us a competitive edge, providing access to proprietary deal flow that helps give our clients an advantage.

Vision

We are committed to making alternative investment solutions accessible to all investors – aiming to deliver consistent risk-adjusted returns and capital preservation across any market environment.

Who we serve

We provide direct access to our teams and leaders, always putting the interests of our stakeholders first.

Alternative asset managers

Financing from every angle. From GP minority stakes to portfolio company financing, our range of capital solutions is the fuel for continued success.

Financial advisors & individual investors

Delivering accessible alternatives. Through access to diversified, compelling investment opportunities, we focus on opening new doors for your portfolios.

Growth tech

companies

Accelerating your growth. From lending to equity investing, we can provide a range of compelling solutions designed for management teams and founders of industry-leading technology companies.

Institutional

investors

Stewards of capital. We are striving to deliver attractive returns and capital preservation for endowments, pension funds, and sovereign wealth funds regardless of economic environments.

Insurance

companies

Innovating insurance asset management. Leveraging our alternatives capabilities and tailored insurance strategies, we seek to deliver innovative solutions that provide insurers with enhanced risk management and stable income generation.