Key Sections

Watch our Midyear Outlook Webcast

Leaders from across our business discuss key themes and potential opportunities for our investment platforms in 2025.

Foreword

We are nearing the midpoint of 2025 with continued confidence in the strength and stability of our business. Our investment strategies are purpose-built to deliver income, preserve capital, and provide inflation protection—characteristics that are attractive in any environment, but prove essential today.

In fact, we believe this moment in time places Blue Owl in a unique position to lead. The unprecedented speed of change in macroeconomic and geopolitical considerations is creating opportunities to invest and amplifying the full value of our solutions-oriented approach to our partners. Blue Owl’s long-term orientation, agility, and discipline positions us to build on our success and further establish our presence across alternatives in the second half of the year.

Several notable trends guide our optimism. We observed broad-based economic resiliency in the United States over the first two quarters, and market innovations remain a powerful driving force. Advances in artificial intelligence have accelerated productivity gains and unlocked compelling and substantial new avenues for investment in digital infrastructure and adjacent areas. These developments are reshaping industries and will create an increasing set of durable, long-term opportunities. This coincides with sustained interest in private credit from an ever-widening set of companies. The privacy and predictability offered by our Direct Lending and Alternative Credit solutions appeals to borrowers, who are increasingly turning to Blue Owl as their capital partner.

Reflecting on US capital markets and related policymaking, we remain clear-eyed and responsive to domestic concerns over the impact of interest rates, tariffs, and a potential economic slowdown. Our team is navigating these dynamics through continuously adaptive measures along with our commitment to focus on the fundamentals. We remain engaged in Washington, and we are gathering early signs of momentum around pro-growth policies, tangible progress on targeted tax relief and deregulation, and interest from policymakers to establish more favorable investment conditions.

We are also closely monitoring geopolitical tensions, particularly the conflict in the Middle East, with the sincere hope for peaceful resolution. From a business perspective, these flashpoints only underscore the value of private capital and its ability to provide long-term certainty during troubling periods.

From a global perspective, economic conditions appear bifurcated. We expect this divergence to continue and perhaps expand through the remainder of the year. Volatility and uneven growth are evident across regions, and although our concentration on private markets solutions and our permanent capital base largely insulates us from cyclical market dislocations, we understand investors’ general unease. We encourage our investors to remain in dialogue with us; our goal is to not only deliver consistent value across market environments, but to engage directly with you on matters of concern.

In the pages that follow, you will hear directly from our investment leaders across Credit, Real Assets, and GP Strategic Capital. Team members will share insights into how Blue Owl is positioned for success, and where they see the most compelling opportunities within their respective asset classes. We thank you for your continued partnership and invite you to explore our midyear outlooks.

Wishing you a productive and prosperous remainder of the year.

Credit

by Craig W. Packer, Co-President, Head of Credit

The first half of 2025 presented myriad challenges and shifting market conditions that, at times, gave investors pause as they reacted to the changing landscape. While our Credit platform has closely monitored these changes and the potential impact they may have on our borrowers and the broader financing market environment, we continue to remain steadfast in our mission to provide a broad suite of attractive financing solutions to our direct lending and alternative credit borrowers across varying market conditions.

Over just a handful of years, we have been witness to a number of periods where public markets pulled back significantly, demonstrating the critical role of private credit managers as liquidity providers in markets seeking reliable, solutions-oriented financing. We believe the value proposition of private credit, which has resonated with investors in relatively sanguine environments, becomes increasingly compelling when global outcomes are incrementally more uncertain. While we continue to see resiliency in the broad economy and relative strength across our Credit portfolio, we have no doubt that economic growth and market expectations remain bifurcated between companies that are affected by potential tariffs and higher-for-longer interest rates and those that are not.

Looking back to April of this year, the rollout of tariffs resulted in a spike in volatility across public equity, credit, FX, and commodities markets, reminding market participants that during periods of stress, correlations move toward the number 1. Within two days, broad stock market indices dropped 10% or more and the VIX index, a measure of market volatility, spiked over 200% in two weeks. Amid this volatility and uncertainty, we witnessed public credit market debt issuance grind to a halt. In fact, between March 29 and April 20 there was not a single public leveraged loan deal issued in the market, the longest stretch since the Global Financial Crisis.1

Since April, we have seen indices rebound and remain remarkably resilient. Sitting here at the midpoint of the year, both the public and private loan markets are relatively open, and we did not see a sustained move toward wider credit spreads, as many initially expected. Public markets have stabilized, but the volatility has not been forgotten. In contrast, the comparable stability of private credit markets has only been amplified during this period. While the impact of tariffs is still playing out and may continue throughout the rest of 2025, private lenders are intently monitoring the on-going situation while continuing to seek out high-quality investment opportunities for scaled, resilient companies.

As we evaluate the potential impacts of the evolving tariff policies on our portfolio, we feel well-prepared for this economic backdrop. Since inception, we have constructed our portfolio—through rigorous underwriting, thoughtful construction, and a diversified platform of loans with more than 400 borrowers—to be defensive across a range of market environments. That posture is borne out of an investment philosophy that seeks out companies with defensive characteristics: recurring revenue models, high customer retention rates, and a focus on services as opposed to supply chains. Furthermore, our portfolio companies are better insulated from tariffs as the vast majority of them are based in and serve customers in the US. Our bias toward service-oriented businesses in areas such as healthcare, financials, insurance, and software mean tariffs have a significantly lower impact. By comparison, traditional fixed income indices such as investment grade, high yield, and leveraged loans are much more exposed to tariff-impacted sectors such as consumer discretionary, energy, industrials, and materials.

We remain vigilant about the potential ripple effects of tariffs, particularly the risk of broader recessionary pressures, shifts in customer demand, supply chain disruptions, and impacts on overall business operations. However, with our scale, conservative portfolio construction, and deep relationships with sponsors and financing sources, we believe Blue Owl is well positioned to be both responsive in partnering with our borrowers as well as in identifying the opportunities this environment may bring.

In focus: Private credit as a preferred partner

Coming into 2025, many market participants expected to finally see a rebound in M&A activity on the back of a new administration perceived to be business friendly as well as some stabilization (or even declines) in interest rates. However, tariff and policy uncertainty in general, combined with continued high interest rates, has caused companies to re-evaluate their supply chains and focus on core operations. In unpredictable markets, it is not surprising to see corporate and financial sponsor activity slow. This plays to private credit’s strengths of stability and partnership, which is why it continues to grow during periods of uncertainty and to solidify its role as a critical source of financing for upper middle market companies.

In fact, over the past decade, one of the largest transformations we have witnessed has been the willingness and, in many cases, the preference of large private equity firms to utilize private loans to finance some of their largest buyouts. This has been one factor in the growth of private credit as an asset class, spurred by the growing investor interest and participation that has allowed private credit managers to provide increasingly scaled solutions for these larger companies.

Private equity dry powder currently exceeds private credit dry powder by approximately 9x, illustrating the pent-up demand for M&A activity once the macro backdrop stabilizes. We believe private credit remains poised to continue to be the partner of choice as private equity sponsors sit on historically high levels of dry powder and buyout activity inevitably ticks up.

We see a parallel opportunity in asset-based finance, which is following in the footsteps of Direct Lending in the evolution towards private financing solutions. As increased cost of deposits, regulation, and higher capital requirements have encouraged banks to optimize their risk capital and focus on customers with whom they have direct relationships, the opportunity set has broadened for asset-based credit investors with the ability to provide more flexible structures and pricing. This reduction in capital supply has afforded us the ability to further expand our relationships with existing borrowers and forge new relationships with seasoned, scaled players who relied primarily on bank capital until bank retrenchment accelerated following the 2022 rate hiking cycle and 2023 regional banking crisis. Since cash is inventory for most of our counterparties in asset-based finance, consistent and reliable access to capital is of paramount importance. To lock in reliable, committed financing, we have observed that our counterparties are willing to offer advantageous pricing and investment structures to scaled players with demonstrated execution capabilities, consistent market presence, and reputations as long-term investors. These dynamics have supported consistent and robust capital deployment across our Alternative Credit platform, and we believe the growth of the asset-based finance opportunity set will remain accelerated in the coming years as private capital continues to replace bank and even public market solutions.

Conclusion

As our Credit business has evolved over the past decade, we have experienced a wide range of market environments, gaining valuable experience in pursuing attractive risk-adjusted returns through market cycles. Our Direct Lending strategy started in 2016 in a relatively benign market climate—which was then upended in 2020 when COVID struck. Since then, we’ve seen skyrocketing inflation, rapid rate hikes, and higher-for-longer base rates. While market conditions have fluctuated significantly, we have remained focused on demonstrating the value of our solutions to borrowers and seeking to deliver differentiated outcomes for investors.

With the addition of our Alternative Credit team, we are now able to offer a similar value proposition to a new set of partners, supported by the team’s decades of expertise and the scale of Blue Owl’s platform. We continue to believe that scale will play a particularly important role in the expansion of private credit markets and look to position ourselves as one of the scaled players in each of the markets in which we invest. Our expansive investment team allows for dedicated and broad sector coverage and expertise, helping us to identify and capture opportunities as they emerge in real time. The ongoing diversification of our platform allows us to widen the funnel of sourcing opportunities as we lean into origination synergies. And as always, we retain our focus on the core goals of pursuing income-driven returns and emphasizing downside protection2 — principles that have helped distinguish Blue Owl for our investors.

Real Assets

By Marc Zahr, Co-President, Global Head of Real Assets

At the start of 2025, real estate investors likely entered the new year with cautious optimism following several difficult years marked by sluggish fundraising and declining valuations due to market volatility. However, that optimism quickly dissipated in early April when new US trade policies sent shockwaves through global markets, introducing new uncertainty for both investors and businesses working to navigate these evolving challenges. Despite the heightened volatility and increased risk, the recent tariff announcements have also created new opportunities to acquire high-quality assets at attractive valuations in our view.

Amid this shifting landscape, we believe the implications of these trade developments are beginning to reshape corporate strategy and, by extension, the real estate market itself. Persistent geopolitical tensions and newly imposed tariffs are expected to accelerate the broader deglobalization trend. Onshoring (situating manufacturing operations in the US) and reshoring (the return of manufacturing operations to the US that had previously moved abroad) are increasingly viewed as strategies that could reduce reliance on foreign supply chains and manage the uncertainties tied to evolving trade policies. Companies are aiming to offset the rising costs of imported goods while positioning themselves to capitalize on supportive government initiatives such as the CHIPS Act and the Inflation Reduction Act. As these efforts gain ground, they are expected to serve as meaningful catalysts for growth across the real estate sector in the future and serve as major themes in Blue Owl’s net lease strategy.

Additionally, sale-leaseback activity has accelerated as companies seek to strengthen their balance sheets amid ongoing uncertainty driven by persistently high interest rates and escalating tariff pressures. This market dislocation – particularly in the net lease sector – has given rise to the most active deal pipelines we have experienced since the inception of our Real Assets platform in 2009 (as Oak Street Capital). Over the past 12 months, we have completed nearly $20 billion in real estate transactions and currently have a near-term pipeline exceeding $40 billion. Our strategy seeks to provide attractive, income-driven returns across market cycles, especially during periods of volatility and dislocation. Since tenants bear the expense risk in a net lease structure and are bound by long-term contracts with regular rent increases, landlords like Blue Owl can rely on a predictable income stream that can be generally insulated from external market factors like inflation. As investors increasingly seek stability, diversification, and downside protection1, we believe net lease real estate continues to be an attractive risk-adjusted opportunity. We anticipate investor sentiment will likely remain skewed toward risk-off strategies as uncertainty persists, which may in turn reinforce demand for high quality net lease assets.

In focus: Digital infrastructure

The rapid explosion of artificial intelligence technology and cloud-based services has dramatically increased the demand for scalable data infrastructure, driving a significant expansion into the global network of data centers. As AI applications become more sophisticated and cloud services become more deeply integrated into daily operations across industries, the volume of data being generated, processed, and stored has surged. We found that major cloud service providers are experiencing capacity constraints and are searching for capital partners that can help them scale to meet their urgent needs of increased data center capacity.

Given the scale of these developments, often reaching billions of dollars, we believe that only a few market players have the financial resources and strategic partnership capabilities to rival our Real Assets’ platform. Our recent acquisition of IPI Partners, a leading digital infrastructure manager, has expanded our data center capabilities and allowed us to become a partner of choice to hyperscalers that are seeking cost efficient and scaled financing solutions.

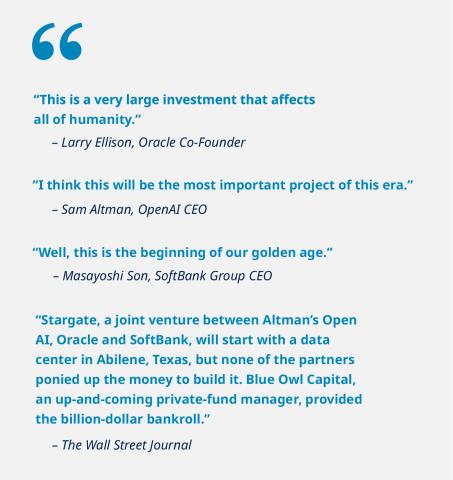

In late January, the White House announced the launch of “Project Stargate,” a $500 billion initiative focused on building cutting-edge artificial intelligence infrastructure across the US. This project is a collaboration between OpenAI, Oracle, and Softbank, and aims to establish the US as a global leader in AI technology. As part of this effort, we recently closed on a $15 billion transaction with Oracle to construct a mission critical data center campus in Abilene, Texas, which serves as the inaugural site for Project Stargate.

Leveraging our investment expertise, relationships with investment grade corporations, and track record of scaled growth, we believe we are well positioned to capture significant growth within the data center industry moving forward.

In focus: Europe

Recent tariff announcements have increased uncertainty around the US economy, likely prompting investors to diversify by expanding their exposure to international real estate. Although the European real estate market is less institutionalized than the US real estate market, strong market tailwinds are driving significant growth potential—particularly in the net lease sector. Increased investment in supply chain resilience and defense spending across European countries are fostering opportunities to reshore production back to the region. In the first quarter of 2025, real estate transaction volume in Europe reached $50 billion, marking nearly a 30% year-over-year increase.2

2025 marks Blue Owl’s extension of its US net lease strategy to Europe. Building off of relationships we have developed with our existing net lease strategy, our team has been actively pursuing sale-leaseback transactions in that region this year. In April, we announced a strategic joint venture with Supermarket Income REIT to monetize a portfolio of eight supermarket assets in the United Kingdom, providing an entry point into a sector in which we have strong conviction. This transaction exemplifies our core investment thesis of acquiring mission critical real estate tenanted by investment grade companies, within sectors that are highly resilient. Beyond this transaction, we have a robust European pipeline with over €3 billion of actionable, near-term deals and more than €30 billion of longer-dated opportunities across grocery and other essential retail, industrial/logistics, data centers, semiconductors, and manufacturing assets primarily located in Western Europe.

As such, Europe has become a strategically important market for Blue Owl’s net lease strategy. The region offers significant opportunities for a differentiated investment platform capable of delivering scale and innovative structuring solutions. By applying the disciplined investment approach that has established Blue Owl as North America’s largest dedicated net lease player, we are confident our European net lease vertical is well-positioned to become a market leader.

In focus: Real estate credit

Rising costs, elevated risks, and continued uncertainty in traditional equity funds have driven capital toward more conservative strategies like real estate credit. Many investors now view the risk-adjusted return profile of equity as less compelling given the narrowing spread between equity and debt returns. As a result, investors are increasingly unwilling to take on additional risk. Private debt has steadily gained a larger share of real estate allocations, representing 24.3% of all capital raised for private real estate vehicles in 2024—the highest annual share in at least seven years. This momentum has carried into 2025 with debt strategies accounting for 26.1% of capital commitments in the first quarter alone.3

The prolonged high-interest rate environment has significantly limited borrowers’ ability to find alternative refinancing solutions, increasing the demand for private debt capital. Recapitalizations are anticipated to fuel transaction activity in 2025 as lenders and borrowers navigate roughly $1 trillion in commercial real estate debt maturing this year. Furthermore, many expect portfolio deterioration to persist in the coming years, with an additional $3 trillion in mortgage loans projected to mature between 2026 and 2028.4

Recently, the team closed a $99.2 million loan for the construction of a build-to-suit beverage warehouse and distribution facility. The property is 100% pre-leased to an investment-grade tenant with an initial 15-year lease term, including annual rent increases and extension options. The location is mission-critical, as the property is adjacent to a significant manufacturing facility the tenant will utilize for manufacturing and distribution.

We believe today’s constrained credit environment and elevated interest rates have created a compelling opportunity for private lenders such as Blue Owl to help bridge the gap. Our team’s ability to meet various counterparty needs, combined with a reputation for operating with speed, creative structuring, and certainty of execution, allows us to capture an outsized market share of attractive opportunities

Conclusion

As we reach the midpoint of 2025, the investment landscape remains shaped by heightened volatility, evolving geopolitical dynamics, and structural shifts in global supply chains. Yet amid the uncertainty, we believe compelling opportunities exist for those who are disciplined in their investment approach and fortunate enough to have dry powder. Blue Owl’s Real Assets platform remains focused on leveraging our differentiated capabilities to deploy capital into sectors that seek to offer durable income, downside protection, and long-term growth. From net lease opportunities in the US and Europe to the expanding real estate credit market and the accelerating demand for digital infrastructure, we see strong momentum across our core verticals. As macroeconomic headwinds persist, our commitment to stringent underwriting, strategic alignment with corporate partners, and long-term value creation will continue to guide our approach. We believe the dislocation we are witnessing today is not a deterrent, but a catalyst for compelling investment opportunities ahead.

GP Strategic Capital

by Michael Rees, Co-President, Head of GP Strategic Capital

Few will need reminding about how quickly the “cautious” optimism that marked the start of the year dissipated. A globally disruptive tariff regime, layered atop ongoing geopolitical dislocation, diverging monetary policies, and uneven growth data, triggered a sharp global sell-off during the first quarter of 2025.

While most major equity indices have retraced those losses1, we believe the market reaction exposed a more structural shift: Elevated baseline volatility2 and an increased concentration in public markets3—shaped by a five-year “permacrisis” and the dominance of passive investing, which now makes up more than half of all U.S. equity fund assets4—has fundamentally altered how institutional capital is allocated and investment opportunities are underwritten in private markets.

The shift is less about market timing—it is about rethinking the framework for long-term capital allocation. In an environment where heightened volatility and uncertainty have become the norm, limited partners are recalibrating how risk is assessed and priced. Traditional measures of outperformance are being reconsidered through a lens that emphasizes stability and downside protection, while cash generation has become a central priority. Performance remains paramount, but its composition is heavily scrutinized. This backdrop is reinforcing the value of strategies built to endure, rather than react.

The GP stakes strategy is well-aligned with this shift. Through our permanent minority investments in top-tier private market firms, we access a portion of the management fee income that these GPs generate—fees that are typically long-dated, tied to committed capital, and diversified across vintages, strategies, and geographies. This creates a stable and diversified cash flow profile that supports an early income stream, while maintaining exposure to the long-term value creation these GPs drive through their underlying portfolios.

The benefits of the GP Stakes model become particularly pronounced in times of stress, where low correlation to both broad public equity markets and traditional fixed income becomes invaluable. The strategy has historically produced a return stream with low cross-asset correlation due to its investment across a wide range of GPs, each of which provide distinct sources of cash flow. As a result, GP Stakes have evolved from a niche strategy to a cornerstone allocation for an increasingly broad range of private market investors.

As permanent equity partners with leading alternative asset managers—firms that collectively manage over $2.4 trillion—we are privileged to observe how the most sophisticated private market participants are navigating this cycle. Volatility is no longer just tolerated—it is being strategically addressed. The managers best positioned to lead in this next phase are those who are adapting with precision and purpose.

In the wake of the tariff announcements, our GP partners moved swiftly to reinforce operational stability. Many activated functional playbooks refined during the COVID period: scenario modeling, budget tightening, stress testing cost pass-through capacity, reassessing supply chains, evaluating onshoring opportunities and preparing capital deployment frameworks for a potential recessionary turn.

Some used the dislocation to reassess pricing and sourcing models, while others increased their participation in secondary markets, deploying dry powder to capture distressed or mispriced assets. The consistent theme among the GPs we invest in is active management informed by experience, agility, and the discipline to avoid reactive decision-making against a rapidly shifting backdrop. Communication with LPs has remained a priority, with an emphasis on transparency and measured confidence.

Trade policy changes and geopolitical instability are now seen as the primary disruptors to the global economy.5 More than 80% of respondents to an Adams Street survey of 200 global LPs and financial advisors expect geopolitical events to impact their investment decision-making. Furthermore, respondents also expect for private markets to outperform public markets over the long term. The key factors behind the anticipated outperformance include reduced volatility in private markets, along with greater innovation, agility, and adaptability.6

In an environment where allocators are increasingly focused on portfolio construction to navigate volatility, private markets offer multiple avenues for investors to enhance risk-adjusted returns and add diversification. We are confident this will continue to drive strategic allocations to private markets—particularly to managers who can demonstrate that they have not just managed through the instability of the last few years but have emerged stronger as a result.

In focus: Capital needs of successful and evolving GPs

While volatility has dominated headlines, leading private market managers have seized the opportunity to reshape their platforms and position themselves to compete in the next decades of growth. This is not a defensive posture—it is a forward-looking investment in scale, specialization and operational efficiencies.

Crucially, these moves require capital. Not fund-level capital, but balance sheet capital—flexible, permanent equity that allows firms to invest in people, technology, and strategic initiatives without ceding control or stretching cash flows. We believe the firms that can execute well today are those with a clear identity, a scaled platform, and a leadership team that has the experience—and capital structure—to navigate complexity.

The phenomenon of 'the big getting bigger' has only gained momentum. In the first quarter of 2025, approximately 42% of capital commitments to global buyout firms were allocated to just six mega-funds.7 This consolidation reflects more than just scale—it reflects LPs’ preference for operational maturity, institutional infrastructure, and multi-strategy resilience. The firms best positioned to thrive are not just taking a larger proportion of capital flows—they are doing so with clearer identity, scalable infrastructure, and broader investor access.

We have observed a consistent focus on building out long-term competitive advantages: from deepening wealth management and insurance channels, to launching new products across credit, secondaries, and infrastructure, and expanding internationally with precision. At the same time, firms are reining in non-core initiatives. Where managers struggled to differentiate or scale, we have observed discipline in platform architecture—shutting down verticals that do not align with their core DNA.

From bolt-ons to full-scale mergers and a proliferation of cross-industry strategic partnerships—private market firms are combining platforms to gain scale, unlock synergies, or access new investor segments. Some of this is defensive—but unlike opportunistic roll-ups in previous cycles, more often it is offensive. Strategic combinations, once considered too complex and reserved only for those with listed equity, are enabling managers to create durable platforms with multichannel distribution, specialized investment teams, and global reach. Scale is becoming an enabler of innovation, not just efficiency.

From our seat, the need to adapt and innovate is clear. While the narrative has focused on instability, the reality is that leading firms are pioneering change. They are sharpening their models, reallocating internal capital, and preparing for a very different future fundraising environment—one that rewards consistency, clarity, and active management above all else. GP commitments into new funds are also expected to grow—an objective that our capital is well-positioned to help support. This alignment helps GPs meet rising LP expectations, increase early deal flow, navigate longer fundraising cycles, and capture emerging opportunities, whether via continuation funds, direct investments, or corporate M&A.

Private markets are not shrinking. They are evolving. And as the industry matures, the firms that will define the next era of growth are those continuously investing in their businesses. The GP stakes market reflects these dynamics in real time. We see accelerating demand for strategic growth capital, reflected in the nearly $2 billion8 we have committed to deals year-to-date, and a pipeline of large and highly established firms seeking to capitalize on structural growth opportunities to maintain their competitive edge.

Conclusion

Even amid challenging market conditions, we remain steadfast in our commitment to back the highest quality global GPs and disciplined in structuring deals that reflect our long-term priorities of alignment and partnership.

Many of our GP relationships are often the product of more than five years, and in some cases over a decade, of strategic dialogue. The decision to sell a piece of the business you have built over 25 years is not taken lightly, and selecting the right partner is of critical importance.

Our momentum is therefore not dictated by market conditions and economic cycles. Rather it is driven by a shared vision of how our capital may help to accelerate the strategic ambitions of large, established managers, motivated to secure the continued success of their firms for generations to come, at the right time for them.

Historical precedent reinforces this: even during the height of the COVID pandemic, our deal flow remained robust, with 2020 marking one of our most active years, as we formed new partnerships with managers we already knew and understood well.

Today, our GP partners manage an average of $45B+ in assets and are more than 20 years old.9 When we enter partnerships, we underwrite their ability to continue to grow over decades, not quarters. These are managers that have navigated multiple periods of instability and emerged stronger. Our partnership model means we stand shoulder to shoulder with them as the private markets industry continues to evolve.

We are particularly proud that over $6.5 billion of the capital we’ve deployed since 2016 has been with existing partners.10 Our solutions continue to fill a vital gap—non-controlling capital designed to support scale, succession and strategic expansion.

Despite the background noise, as we advance through the remainder of 2025, we see a dynamic deal-making environment, rich with opportunities for continued success in a rapidly changing industry. Our model was designed for moments like these—flexible, patient, and rooted in partnership.

Endnotes

Credit

- https://my.pitchbook.com/credit-analysis-news/article/12530386

- References to “downside protection” or similar language are not guarantees against loss of investment capital or value.

Real Assets

- References to “downside protection” or similar language are not guarantees against loss of investment capital or value.

- PERE May 2025 Issue

- PERE May 2025

- Recapitalizations seen driving 2025 transaction activity

GP Strategic Capital

- Financial Times. “Markets Data: Global Indices Performance.” FT.com, June 12, 2025. Accessed June 13, 2025. https://markets.ft.com/data/

- VIX Index average from January 1, 2020, to June 13, 2025, at 21.4 vs January 1, 2014 to December 31, 2019, average 15.0

- JPMorgan. “Is Stock Market Concentration Rising?” J.P. Morgan Research, February 15, 2024. Accessed June 13, 2025. https://www.jpmorgan.com/insights/global-research/markets/market-concentration

- Based on analysis by Brightman and Harvey (2025) using data from Morningstar, as of December 31, 2024, U.S. open-ended funds and ETFs (including obsolete funds) were included in the study. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5259427

- McKinsey & Company. (2025, April 23). Trade turmoil takes hold. https://www.mckinsey.com/featured-insights/sustainable-inclusive-growth/charts/trade-turmoil-takes-hold

- Adam Street 2025 Investor Survey published March 21, 2025 (June 2025) https://www.adamsstreetpartners.com/insights/2025-global-investor-survey/

- Pitchbook

- As of 5/28/2025

- As of December 31, 2024

- As of March 12, 2025

Important information

Unless otherwise indicated, the information referenced herein is as of June 25, 2025.

Past performance is not a guarantee of future results.

This material contains proprietary information regarding Blue Owl Capital Inc. (“Blue Owl”), its affiliates and investment program, and may not be reproduced or distributed without express permission from Blue Owl.

The views expressed and, except as otherwise indicated, the information provided are as of the date herein and are subject to revision and verification, materially or otherwise, without notice, as market or other conditions change. Since these conditions can change frequently, there can be no assurance that the trends described herein will continue or that any forecasts are accurate. In addition, certain of the statements contained in this presentation may be statements of future expectations and other forward-looking statements that are based on the current views and assumptions of Blue Owl and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements. These statements may be forward-looking by reason of context or identified by words such as "may, will, should, expects, plans, intends, anticipates, believes, estimates, predicts, potential or continue" and other similar expressions. Neither Blue Owl, its affiliates, nor any of Blue Owl's or its affiliates' respective advisers, members, directors, officers, partners, agents, representatives or employees or any other person (collectively the “Blue Owl Entities”) is under any obligation to update or keep current the information contained in this document.

All investments are subject to risk, including the loss of the principal amount invested.

This material is for educational and informational purposes only and is not an offer or a solicitation to sell or subscribe to any fund and does not constitute investment, legal, regulatory, business, tax, financial, accounting, or other advice or a recommendation regarding any securities of Blue Owl, or any fund or vehicle managed by Blue Owl, or of any other issuer of securities.

This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Blue Owl. It is delivered on an “as is” basis without warranty or liability. All individual charts, graphs and other elements contained within the information are also copyrighted works and may be owned by a party other than Blue Owl, which Blue Owl has not verified. No representation or warranty, express or implied, is given by or on behalf of the Blue Owl Entities as to the accuracy, fairness, correctness or completeness of the information or opinions contained in this material, and no liability whatsoever (in negligence or otherwise) is accepted by the Blue Owl Entities for any loss howsoever arising, directly or indirectly, from any use of this material or its contents, or otherwise arising in connection therewith. By accepting the information, you agree to abide by all applicable copyright and other laws, as well as any additional copyright notices or restrictions contained in the information.

Copyright© Blue Owl Capital Inc. 2025. All rights reserved.